Probate Publications: Information, Timlines And Definitions

Probate Guides

Inheritance Loans: Can You Get a Loan on Your Inheritance?

Many people search for inheritance loans when they are in the long probate process and waiting to receive a distribution of probate assets. An inheritance

How To Recover Stolen Inheritance

Losing an inheritance can be a devastating experience, especially if it was stolen by someone you trusted. Whether it was taken through fraud, embezzlement, or

How Do Probate Loans Work? (A Comprehensive Guide To Get Quick Funding)

If you are the heir or beneficiary to an estate and have found yourself stuck in the probate process waiting to receive your final distribution,

7 Ways to Receive An Early Distribution Of Probate (Inheritance Funding)

Receiving your inheritance early may look like a straightforward procedure but it can take a long time to go through probate. If you are a

When Is Probate Required?

Probate refers to everything that happens to the assets of a deceased person, starting from gathering the entire estate and ending at administration to heirs

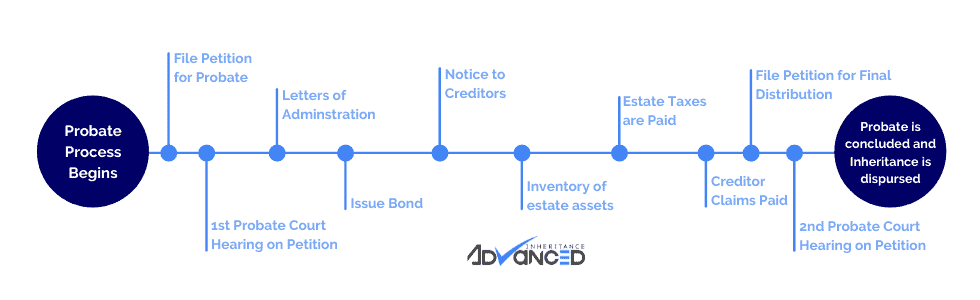

How Long Does Probate Take? Steps, Timeline, and Process

If you are wondering how long probate takes, there might no be a simple answer. Probate court timelines can vary based on the laws of

What Is Probate? Everything You Need to Know About The Probate Process

Probate is a legal process that involves administering the will of a deceased person. In most cases, the court oversees the process to make sure

Wills In Probate: Is A Will Required?

Wills In Probate: Is A Will Required? No! Not every will must undergo probate. However, there are a few instances in which a Will could avoid

When is Probate Not Necessary? A Detailed Guide

The term “probate” refers to the legal process that transfers assets from one person to another. In the case of large estates, it can be

Probate Cost & Statistics

Inheritance Loans: Can You Get a Loan on Your Inheritance?

Many people search for inheritance loans when they are in the long probate process and waiting to receive a distribution of probate assets. An inheritance

How To Recover Stolen Inheritance

Losing an inheritance can be a devastating experience, especially if it was stolen by someone you trusted. Whether it was taken through fraud, embezzlement, or

How Do Probate Loans Work? (A Comprehensive Guide To Get Quick Funding)

If you are the heir or beneficiary to an estate and have found yourself stuck in the probate process waiting to receive your final distribution,

7 Ways to Receive An Early Distribution Of Probate (Inheritance Funding)

Receiving your inheritance early may look like a straightforward procedure but it can take a long time to go through probate. If you are a

What are Americans Paying In Probate? (Statistical Analysis)

Every year, hundreds of thousands of people that have lost loved ones go through probate. Probate is the court process of passing on the decedents

How Long Do You Have To File Probate After Death?

The loss of a loved one is a sad and painful moment for friends, family, and other people who were close to them. The people

How Much Does An Estate Have To Be Worth To Go To Probate?

Each state has different laws that determine whether or not the probate court process is necessary for an estate. Sometimes probate is decided according to

How Much Does Probate Cost in Florida?

Unless you’ve taken steps ahead of time to avoid probate, your loved ones will likely have to take at least some of your estate through

Probate Court

Inheritance Loans: Can You Get a Loan on Your Inheritance?

Many people search for inheritance loans when they are in the long probate process and waiting to receive a distribution of probate assets. An inheritance

How To Recover Stolen Inheritance

Losing an inheritance can be a devastating experience, especially if it was stolen by someone you trusted. Whether it was taken through fraud, embezzlement, or

How Do Probate Loans Work? (A Comprehensive Guide To Get Quick Funding)

If you are the heir or beneficiary to an estate and have found yourself stuck in the probate process waiting to receive your final distribution,

7 Ways to Receive An Early Distribution Of Probate (Inheritance Funding)

Receiving your inheritance early may look like a straightforward procedure but it can take a long time to go through probate. If you are a

What Happens at a Probate Court Hearing?

The death of a loved one is never easy, even if they have been sick for a long period. Probate court hearings occur for the

Wills In Probate: Is A Will Required?

Wills In Probate: Is A Will Required? No! Not every will must undergo probate. However, there are a few instances in which a Will could avoid

4 Consequences Of Not Probating A Will

The proceedings that take place in probate court (during which the assets of a deceased person are transferred to the individuals who inherit them) can

How Long Do You Have To File Probate After Death?

The loss of a loved one is a sad and painful moment for friends, family, and other people who were close to them. The people

How do you petition the court to open a probate?

The court cannot begin a probate matter unless it is petitioned to do so. After the death of the estate, the court must be informed

U.S. Probate Court cases are backlogged after the coronavirus shutdown

The coronavirus outbreak brought the world to its knees without anyone seeing it coming. No one was left unaffected by it, including schools, hospitals, businesses, and legal institutions.

Probate Advances & Loan Guides

How Do Probate Loans Work? (A Comprehensive Guide To Get Quick Funding)

If you are the heir or beneficiary to an estate and have found yourself stuck in the probate process waiting to receive your final distribution,

Inheritance Loans: Can You Get a Loan on Your Inheritance?

Many people search for inheritance loans when they are in the long probate process and waiting to receive a distribution of probate assets. An inheritance

How To Recover Stolen Inheritance

Losing an inheritance can be a devastating experience, especially if it was stolen by someone you trusted. Whether it was taken through fraud, embezzlement, or

7 Ways to Receive An Early Distribution Of Probate (Inheritance Funding)

Receiving your inheritance early may look like a straightforward procedure but it can take a long time to go through probate. If you are a

Determining The Amount Of Money You Can Receive As Advance On Your Inheritance [Easy Calculator]

Receiving an inheritance advance and the amount of the advance is largely dependent upon the size of your estate inheritance that is in probate and

What Is a Probate Advance? Definition, Types And Uses.

Many estate heirs and executors find themselves in a position where they need money right away. A probate advance is a funding solution that enables

How to Find Out What Your Probate Inheritance is Worth

The probate process can be complex especially if there are no wills or if there are issues related to debts, beneficiary designations and joint assets

Probate Loan Rates and Estimated Interest Costs

Probate loans are a loan made against inheritance while the heir is waiting to receive a probate distribution. Many heirs and beneficiaries of an estate

Does a probate advance affect the other heirs in an estate?

Probates are complex, and they take a long time. Average probate can stretch out for anywhere from nine to 24 months. The fact that all

Who Is involved In probate?

There are many people involved in the probate process and many times there are multiple names for the same person. Because different states refer to the same person with different names, probate can be confusing when talking about it on a national level. It’s important to know the key roles and people involved in probate.

- Decedent

- Debtor

- Custodian

- Testator

- Testate

- Trustee

- Notary public

- Legatee

- Heir

- Guardian ad litem

- Guardian

- Grantor

- Conservator

- Executor

- Creditor

- Beneficiary

- Administrator

- Minor

- Probate Attorney

There are many more individuals that may be involved in probate and some states use different terms to refer to the same person.

Probate Terms

If you are pulling your hair out trying to understand the probate process, you aren’t alone. Probate is the process in which the court makes sure that a deceased person’s debts are paid and remaining assets are distributed to the correct beneficiaries. The term probate is used to describe the legal process that manages the assets and liabilities left behind by a recently deceased person.

Probate is only necessary if a clear beneficiary is not named for all assets after someone passes away. If a beneficiary is not named, then the court has a responsibility to make sure the assets are taken care of and passed to successors and creditors are paid. Probate will last longer and be more complex based upon how many beneficiaries are involved if an active business is part of the deceased assets and the general complexity of the estate.

States Have Different Probate Laws

One states probate laws are different from another states. For instance, in Florida, the term personal representative is used instead of executor which is used in California. Since each state has individual tax laws and process, you can find a full list of probate state laws here.

John Marsano

Legal Disclaimer: Please note that Inheritance Advanced is not a lender. Inheritance advance does not provide probate loans, inheritance loans, or estate loans, rather, an advance on a portion of proceeds signed over to Inheritance Advanced. Inheritance Advanced is also not a probate attorney and any information in this article should not be misconstrued as legal advice. We recommend that you seek the advice of an attorney, CPA, and tax attorney regarding any decisions pertaining to your probate.

Get Your Inheritance Money Now!

Our Inheritance Cash Advances help heirs receive a portion of their inheritance payout in just a few days. We then wait and are paid directly out of your share when the estate finally closes. We wait for probate so that you don’t have to. Click below and fill out our short form to receive an advance immediately.