When faced with a long wait for an inheritance, many people start looking for ways to receive an early distribution in the form of an estate loan. An estate loan is a loan that occurs during probate that lasts for the term of the probate process and requires interest payments. Many times an estate loan has to be secured by assets outside of the estate. Along with needing to be collateralized by an asset, estate loans require credit checks and go through the full process of bank lending.

Estate loans is typically something that beneficiaries apply for and receive after someone passes away that has bequeathed assets to an estate, the beneficiaries or beneficiary may want to get an estate loan if the estate goes into probate.

An example of an estate loan would look as follows: Jenny’s father Bruce passes away and leaves jenny $500,000 in a stock portfolio and a house. However, Bruces estate goes into probate which will take 8 months to 24 months to conclude before Jenny actually receives the inheritance. In the meantime, Jenny has to cover expenses such as the funeral costs and upkeep of the estate. Jenny applies for an estate loan to cover the expenses in the interim before final distribution of the estate occurs.

Can You Borrow Money from an Estate?

Since the assets from the estate have not been transferred in title, technically, none of the assets are yours which makes it very difficult to borrow money. You can try to get an estate loan, but most banks won’t lend money on collateral that isn’t transferred in title under your name. For instance, you wouldn’t be able to get a real estate loan on a house in the estate because you don not actually own the home until probate is finished and final distribution occurs. Most real estate loans are made using the title as collateral. You have no equity in the house because it doesn’t belong to you until probate finishes but there are other financial tools that can be used to obtain money immediately. One of those tools is an inheritance cash advance.

What Is The Structure of An Estate Loan In The Context of Probate?

Certain standards have been established for estate loans. The structure of estate loans is similar to that of receiving a mortgage on an inherited property. An estate loan can be hard to receive for the following reasons:

- The loan must be backed by an asset and the estate is not technically yours until probate is concluded.

- Lenders go through very thorough credit checks

- Lenders check criminal history

- Lenders check employment history before tendering the estate loan.

- If you do not meet the requirements for an estate loan, there are other options like a probate advance.

An estate loan is different than a probate advance

An estate loan is different than a probate advance which is a typical cash advance that is provided in exchange for the future distribution that will come when the probate is concluded. An estate loan is a commercial loan that requires credit checks and assets to back the loan. A probate advance is a funding tool that makes it easier to receive money quickly and easily during probate.

To illustrate the difference between an Estate Loan and A Probate Advance (synonym for inheritance advance) we will use the example of Jenny and her father again.

Example Of An Estate Loan:

An example of an estate loan would look as follows: Jenny’s father Bruce passes away and leaves jenny $500,000 in a stock portfolio and a house. However, Bruces estate goes into probate which will take 8 months to 24 months to conclude before Jenny actually receives the inheritance. In the meantime, Jenny has to cover expenses such as the funeral costs and upkeep of the estate. Jenny applies for an estate loan to cover the expenses in the interim before final distribution of the estate occurs. Jenny’s estate loan is backed by her personal credit and jenny has to pay interest on the loan every month that she receives until she can pay off the loan which will most likely occur when she receives final distribution of her father Bruces Estate.

Example of an Inhertance advance:

An Inheitance advance would start the same way as an estate loan where Jenny finds herself waiting to receive her inheritance as it goes through the probate process. Jenny needs money and can’t wait for probate to finish so she sells a portion of her future inheritance in return for immediate money. The company that provides the advance then needs to wait for probate to conclude to be paid back. With inheritance advances, the advance company assumes the risk of waiting until the probate case ends. There are no interest payments and no qualifications outside of verifying the amount of inheritance and that you are in fact the beneficiary of the estate.

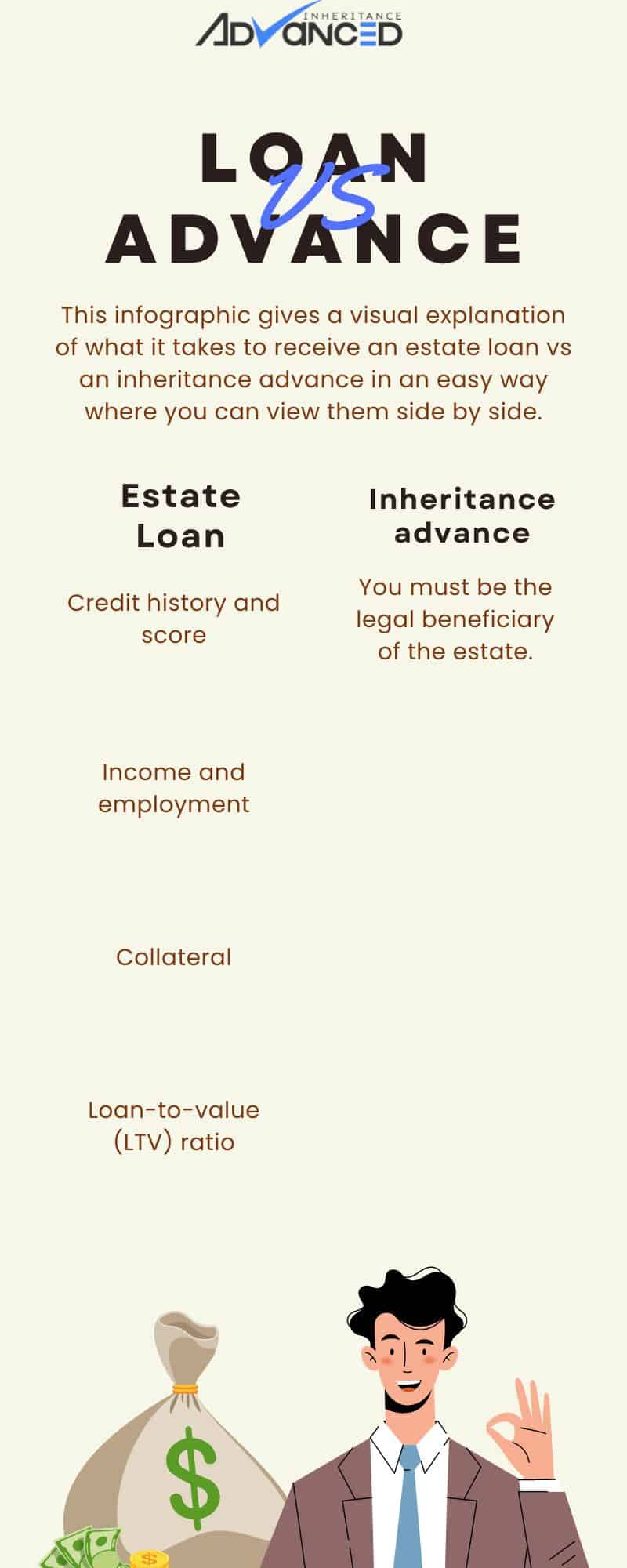

What Factors Are Involved In Getting Approved For An Estate Loan?

Banks typically consider several factors when deciding whether to approve an estate loan application. These factors include:

-

Credit history and score: Banks look at the borrower’s credit history and credit score to determine their creditworthiness and the risk of lending money to them.

-

Income and employment: Banks want to make sure that the borrower has a stable source of income and is employed. They may also consider the borrower’s income-to-debt ratio and monthly expenses.

-

Collateral: Some loans may require collateral, such as a property or a vehicle, to secure the loan. The value of the collateral is also considered in the loan decision. It’s important to note that you can not use the estate as collateral for an estate loan since the title of the estate assets does not transfer to the beneficiary until probate has concluded and final distribution has taken place.

-

Purpose of the loan: Banks may consider the purpose of the loan, such as whether it is for a business or personal use, and whether it aligns with their lending policies.

-

Loan amount and repayment terms: Banks consider the loan amount and the repayment terms, including the interest rate and the length of the loan, to determine the risk of the loan.

-

Loan-to-value (LTV) ratio: For secured loans, such as a mortgage, the LTV ratio is an important factor. It is the ratio of the loan amount to the value of the collateral. A higher LTV ratio may indicate a higher risk of default, which may affect the loan decision.

These are some of the key factors that banks consider when deciding whether to approve a loan application.

Can You Borrow Money From An Estate?

If the funds from the estate are not yet in your possession, obtaining a loan can prove to be a challenge. Traditional banks may hesitate to lend money using the estate as collateral since the assets are not yet in your name. For instance, securing a real estate loan using the house in the estate as collateral may not be possible since you do not hold the title. Real estate loans typically require the title as collateral. The lack of ownership of the property during probate proceedings means that you do not have any equity in the house.

Other loan options, such as personal loans or borrowing against your retirement, may not allow the use of the estate as collateral. An alternative option is to consider obtaining an inheritance advance, also known as a probate advance, from a probate funding company or using a hard money lender. These lenders offer loans based on your inheritance, with the expectation of monthly payments until probate is completed.

The funds from an inheritance advance can be utilized for a variety of purposes, such as paying off debts, taking a vacation, or purchasing a car. You won’t need to provide any real property as collateral since the loan approval and amount are based on the inheritance. The loan balance will likely require monthly payments until the estate is settled, at which point the balance can be fully paid off.

What Are The Benefits of An Estate Cash Advance?

If you need funds, an estate cash advance is a viable option that offers several advantages over traditional loans. With this option, you don’t need to have a high credit score or perfect credit, as lenders base their decision on the inheritance rather than your financial history. The approval process is usually quick, and you can receive the funds in a matter of days. You can use the money for various purposes, such as paying bills, taking a vacation, or making a large purchase.

The best part is, you are not obligated to repay the funds, as the finance company will get the money from the inheritance once it’s released. The terms are fixed when you sign the contract and can’t change, making the option low-risk for the borrower. Estate cash advances are non-recourse, meaning that the borrower is not held responsible for the repayment of the funds even if the terms of the inheritance change after the contract is signed. Inheritance Advance provides estate cash advances with the added benefit of not requiring interest payments as with traditional loans. The borrower is protected in case the terms of the inheritance change after the contract is signed, making it a low-risk option.

Can you use an estate loan to buy out siblings?

How much does an estate loan cost?

Rates on estate loans many times vary but they last for the duration of the probate matter. As an example: If an estate loan is 15% annually and the probate takes 3 years to close, then the loan will ultimately cost 45% of the money that is lent. For instance, if you receive \$20,000, the loan would cost around \$10,000, meaning the beneficiary would need to pay back \$30,000. A probate advance cost does not have as many variables because the amount of money is agreed upon up front without interest fees that accrue every month. The agreed-upon terms are exactly what they will cost. There is no accrual of interest payments with an estate advance. Probate loan rates vary based upon multiple factors.

Can you use an estate loan to pay inheritance taxes?

When it comes to estate loans, there are predefined ways that you have to use the money. You may or may not be able to use a loan to pay for inheritance or estate taxes. A probate advance can be used however you want. Inheritance taxes is a good use of estate advance proceeds.

Get An Estate Advance Today!

At Inheritance Advanced, we provide inheritance advances rather than loans because they are easier to secure and better for heirs and beneficiaries. If you need to pay bills and need money for things like funeral costs a cash advance is a great option. You can use the proceeds however you want.

You do not have to worry about your credit score and the difficult probate process, or estate lending process for that matter. We don’t even look at it when applying, and we never dictate what or how much money you can use the way some other companies do – there’s always something in our budget for whatever your heart desires! After all, the inheritance belongs to you. Many estate heirs and executors find themselves in a position where they need money right away and estate loans aren’t an option for them. A probate advance is one option to receive funding that enables you to get your inheritance faster, but with the downside of receiving less once it’s over. We’ve helped 1,500 people from all around the country who needed their money sooner than later because we understand how difficult waiting for funds can be on an individual.