A person who transfers assets into a trust for the benefit of another. It’s important to be clear about which role this individual will have with regard to managing those funds; they can either act as grantor (someone granting you legal ownership) or co-trustee, in addition to holding other titles.

An Picture Example Of A Trustor

The trustor is the person or entity who sets up the trust and the process for assets to be held in the trust. This is usually done with the help of a probate or trust attorney.

Who Are Trustors?

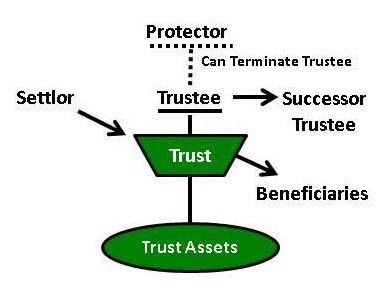

A trustor is an entity that creates and opens a trust. Trustors can be individuals, married couples, and organizations. Trustors work with trustees to safeguard and distribute their assets, including money and property. A trustee assumes the fiduciary duty from a trustor.

Trustors are different from trustees

Trustors are the individuals or entity that creates the trust and the trustees are tne indivual, individuals or entitee responsible for managing its assets. A trustee is a person who takes responsibility for managing money or assets that have been set aside in a trust for the benefit of someone else.A trustee, must use the money or assets in the trust only for the beneficiary’s benefit while the trustor is the individual who opens the trust and typically owned the assets previously before transferring ownership to the trust.

Difference between trustors and decedents

A trustor takes the time to set up a trust so that the assets are held in trust and pass to a beneficiary without a probate proceeding. Decedents are individuals who have passed away and typically their assets go through the probate process or have beneficiaries on their accounts so they pass directly to heirs. When a trustor sets up a trust, they are forgoing ownership of assets and the assets are henceforth owned by the trust.

« Back to Glossary Index