An estate accounting is different from trust accounting because of the time and purpose for which it takes place, however, trust accounting follows a similar procedure with that of an estate in probate. As the trustee is also required to report all occurrences since they took over the trust and also list the names and addresses of all beneficiaries like an executor would. The account would include all unpaid claims with a detailed explanation about why they have not been paid. The plan on how the assets will be distributed will also be presented by the trustee to the court.

Estate Accounting & Trust Accounting Are Different

Estate accounting and trust accounting are important reports that are required from the executor or trustee to ensure there is transparency and accountability in the handling of the estate. Since it is their job to oversee the estate until the assets are distributed, they should be straightforward in their dealings and follow the law in executing their tasks.

Heirs To A Trust Can Not Receive Cash Advances

It’s important to distinguish an heir to trust and a beneficiary of an estate that is being probated. If a beneficiary has money stuck in probate they can receive a probate cash advance to get their inheritance money early. This is different from a trust which is set up with specific rules and guidelines which many times prohibit such options.

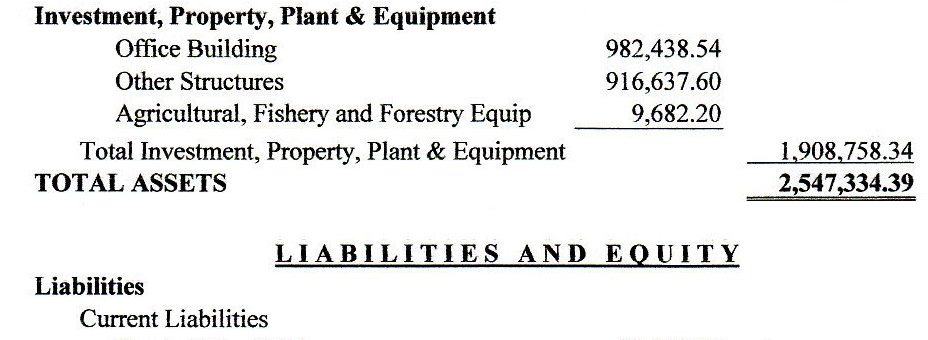

Example Of Trust Accounting

Trust accounting is usually done by a certified tax professional and must adhere to specific requirements.

Trust accounting is not needed for probate

Trust accounting is different from probate accounting and does not need to be reviewed by the probate courts. Trust accounting also must be submitted for tax returns unlike an accounting of an estate that happens during probate.

An Inventory of Probate Assets VS Estate Accounting

The word probate is used to describe the legal process by which the estate of a deceased person is collected and after legal conditions have been met, administered to the beneficiaries. This process is ridden with a lot of technicalities and this makes it a very long and confusing process. It is therefore quite easy to get confused.

Two phrases are commonplace throughout this process. The inventory of probate assets and estate accounting. Following a probate inventory checklist can help make things organized. Let us take a look at these two phrases and what they mean.

An inventory of probate assets is usually an attempt at validating the will of the decedent. This inventory is carried out by the estate administrator or executor and it accounts for the decedent’s assets and a valuation of the said assets. This is then presented to the court. This serves the purpose of providing the date of death values of the assets and forms a starting point for the disbursement of the estate to beneficiaries. It also forms the basis of other accounting processes.

Estate accounting on the other hand serves the purpose of reflecting the changes that occurred to the estate during the process of administration. It records the differences in assets and liabilities of the estate during the probate process.

Let us take a closer look at these two concepts.

The Basics Of Probate Accounting

After an administrator files for probate, the process of probate accounting is started. A probate accounting is a legally binding record of an estate in probate. In most cases, an inventory form is sent to the executioner of the estate and it is this executioner that creates an inventory of all the assets of the decedent that were subject to probate at the time of death. This is usually one of the first tasks of the executor as it will go a long way invalidating the will of the decedent, if there is any, It will also be a guide on how the distribution of the estate should be. Probate accounting is a process that will continue throughout the period of probate and it is usually done in three phases.

- The Beginning Inventory

The process of probate accounting starts with an inventory. The inventory form is usually provided by the state and it varies from state to state. The form that is provided by your state will be broken into sections that require a thorough description of the different forms of assets that are considered probate assets by the state. The value of these inheritance assets at the date of death is also listed and a fair market price is given to the assets. Some of these assets might require an appraisal in order to determine their value while the valuation of the other assets can easily be done by financial institutions in charge of them

Money that is owed to the decedent that has not been paid is also included in this inventory. This is the first stage of probate accounting.

- Recording Receipts and Disbursements

As the process of probate continues, there might be changes that occur to the value of the estate. The value of some assets might decrease or increase. There might also be administrative payments that need to be paid on behalf of the estate. The expenses for the decedent’s funeral as well as the medical debt incurred before debt would have to be paid. Other forms of debt owed by the estate also need to be paid. This would definitely cause a decrease in the total value of the estate.

Funds can also come into the estate in the form of payment of a debt owed to the decedents, dividends, tax refunds, or even interest on finances in the back account. The implication is a net increase in the value of the estate.

The executor of the estate should be on top of all these changes, noting them and keeping records as part of the probate accounting process.

The best way to monitor the changes in the valuation of the estate is by opening a new estate account where all the financial assets of the estate will be transferred into. The debts owed by the decedents will be paid from this account and all forms of income generated by the estate will be paid into this account. In this way, adequate records of these transactions will be kept.

Once all the debts owed by the decedents have been paid off and all the funds due to them have been received, a final valuation of the estate can be carried out and the assets distributed to the beneficiaries accordingly as stated in the will or as stipulated by law.

- Final Accounting

This is the final inventory of the estate assets. It contains the basics that were present in the initial inventory. It also contains all the recorded changes that happened during the entire probate. It might not list all the transactions but records of such transactions should be kept just in case a beneficiary disputes this final accounting.

The Basics Of Estate Accounting

An estate accounting is a record of the assets that were in the estate at the time of the decedent’s death. It also includes all the changes that were made to the valuation of the estate since the death of the decedents. It also includes, in detail, how the estate funds were spent and what assets are remaining in the estate at the time of accounting. The estate accounting also shows how what is left in the estate would be shared among the beneficiaries.

The first thing that an executor does while creating an estate accounting is to generate a complete list of all the assets/properties that were present in the estate at the time of the decedent’s death.

If a decedent was resourceful enough to go through the process of estate planning while they were still alive, then they would have reduced the work of the estate administrator in regards to estate accounting. This is especially true if the decedent has a very detailed will. This will make the process of curating this list so much easier. However, in the absence of a detailed will, the executor might have to carry out surveys to get a detailed list of the estate’s assets.

This is the first stage of estate accounting and probably the most important. At the end of the probate period, the executor should be able to provide accounts of what they did during the probate period and how the assets were distributed among the beneficiaries.

The Difference Between Probate and Estate Planning

Estate administration is a process that requires planning and since the basic definition of probate and estate planning is the planning for the seamless distribution of an estate it might become a bit confusing. In reality, the differences between these two processes are timing and the process. The endgame is usually to ensure that the decedent’s wishes for their assets are carried out.

It is important to note here that no matter the size of assets, everyone has an estate, and proper planning of the distribution of this estate is important. This is the reason it becomes necessary to start planning for this distribution so that at the occurrence of death there would be a guide to the whole estate distribution among beneficiaries.

That is the whole goal of estate planning. Estate planning is the process of designating the way your estate would be distributed among the various beneficiaries. With estate planning, there is no need to wait till the estate gets to a certain size before planning starts. The process of estate planning is a continuous one that might continue till the death of the estate owner. With estate planning, the goal is to create a platform that can be changed and finetuned until the event of death.

Estate administration and Probate are different because probate occurs after death but serves the same purpose of ensuring seamless distribution of the decedent’s estate. The goal is to make sure that the decedent’s wishes during the estate planning process, if any, are followed as closely as possible.

While the estate planning process is handled by the owner before their death, the probate process is handled by the estate administrator and the court. During the probate process, it is decided how the probate assets of the decedent’s estate will be distributed among the beneficiaries and the only way to help this process along is if the decedent had carefully thought out and enforced a thorough estate planning process.

It is important to note here that estate planning might have an effect on non-probate assets but the probate process will only handle probate assets and hence non-probate assets are ways to bypass a probate court and have assets that go directly to the beneficiaries.

« Back to Glossary Index