Probate refers to everything that happens to the assets of a deceased person, starting from gathering the entire estate and ending at administration to heirs and beneficiaries.

This process is required in most cases, as it provides a seamless, legal way to distribute the deceased’s estate exactly how they would have wanted it. However, there are cases where it may not be needed. We will show you those cases.

Is Probate Required If There Is Already A Will?

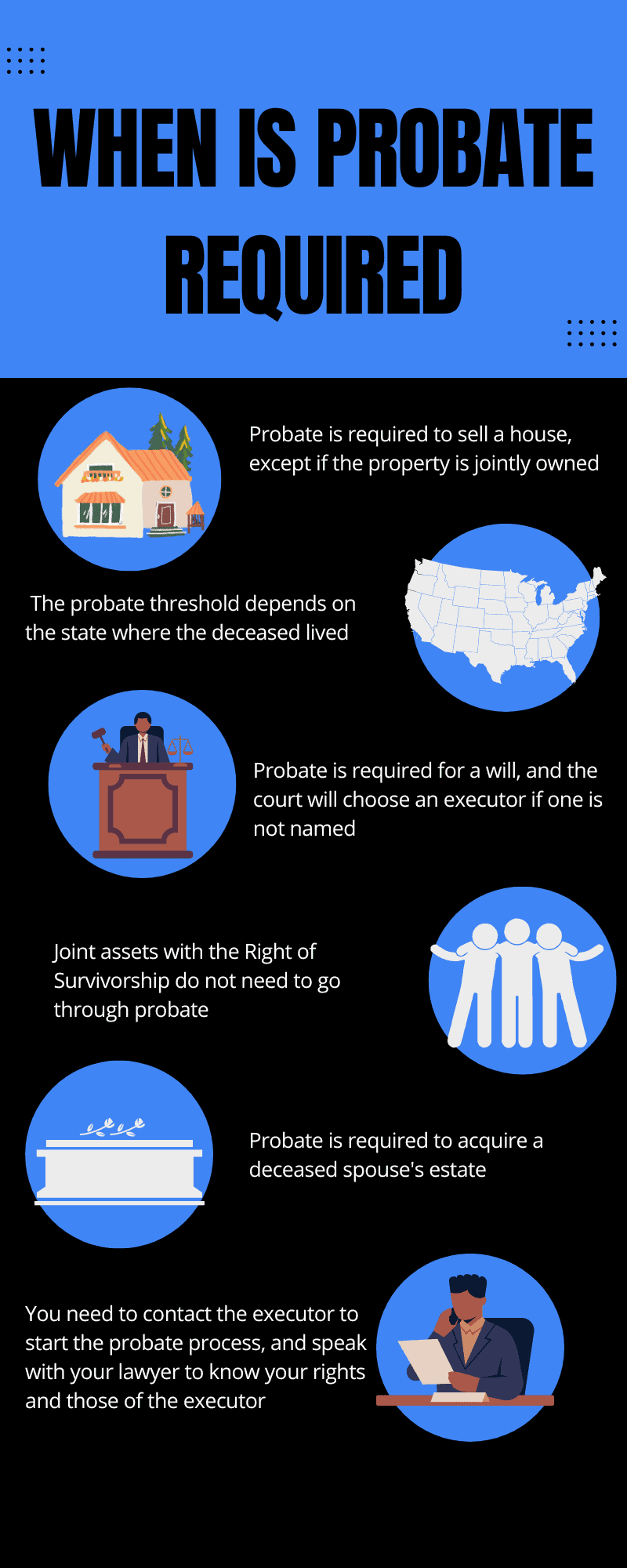

The probate process will take place whether there is a will or not. As long as the deceased’s estate is up to the threshold, that can go through probate. The probate process is the same for when there is a will and when there is none. However, some of the terms may be different.

What Is The Threshold For Assets That Can Go Through Probate?

This depends on the state where the deceased lived. In some states, a few thousand dollars will go through probate; in others, the threshold is $200,000 or more. It is important to speak with your attorneys to know if you would need to go to court to distribute the property.

Do I Need Probate If An Executor Is Not Named In The Will?

Most wills will name an executor to help the family, heirs, and beneficiaries to distribute the estate. However, the probate court will choose one in certain rare situations where an executor is not named. The executor is responsible for gathering the deceased’s estates, paying off creditors, and administering the estate.

Is Probate Required For A Joint Asset?

Every joint asset comes with the Right of Survivorship. When a person dies, leaving a jointly owned asset behind, the other person assumes ownership of the asset and will not need to go through probate. However, if the asset is owned as “tenants in common,” each party owns only a percentage of the asset and will retain that value after death. The Right of Survivorship does not come to play here.

Do I Need Probate To Acquire The Assets Of My Spouse?

You may need to go through probate to legally acquire a deceased spouse’s estate. This will depend on certain factors, such as whether the estate amount is up to the threshold that can go through probate and whether the property is jointly owned.

Is Probate Required To Sell A House?

The probate process must be completed before any property sale can occur. However, it may not be required if the property is jointly owned. If the property is owned as tenants in common, it must go through probate as long as the entire estate reaches the probate threshold.

Do You Have A Will But Don’t Know Where To Start?

When a deceased loved one leaves an estate behind, they usually name one or more executors to help administer their estate. The executor takes the will to court to request a grant of probate that allows them access to the deceased’s bank accounts and legal documents, which allows them to take action.

Conclusion

In most cases, when there is a will for estates to be administered, there is a need to go through probate. It is essential to contact the executor to begin the process as soon as possible. You should also speak with your attorney to know your rights and those of the executor.If the deceased has not named an executor, the probate court will choose an independent person or body to serve as an intermediary between the court and the beneficiaries.

Contact Inheritance Advance Today

If you are dealing with probate and need help, contact Inheritance Advance today! Our team of professionals can help you navigate the process and ensure the assets of your loved one are distributed according to their wishes. Don’t wait – contact us now to get the help you need.