Introduction to Probate Sales

When a person passes away, they often leave behind assets, including real estate. If the deceased person didn’t specify in a will who should inherit the property, or if the estate needs to liquidate assets to pay off debts, a probate sale may be necessary.

A probate sale is a way to sell property that is part of a deceased person’s estate. It’s overseen by a court or a designated representative, often an executor or administrator of the estate. The purpose of a probate sale is to ensure that the property is sold at a fair market price and that the proceeds are used to settle any debts, taxes, and expenses of the estate. Once these obligations are met, the remaining funds are distributed to the heirs.

Probate sales are a unique type of property transaction, with specific rules and procedures that differ from standard real estate sales. They can be complex and time-consuming, but they can also present opportunities for buyers to purchase property below market value.

It’s important for both sellers and buyers to understand what a probate sale involves, why it’s necessary, and how it works. This understanding can help make the process smoother and more manageable. In the following sections, we’ll delve deeper into the process of a probate sale, its pros and cons, and other important aspects to consider.

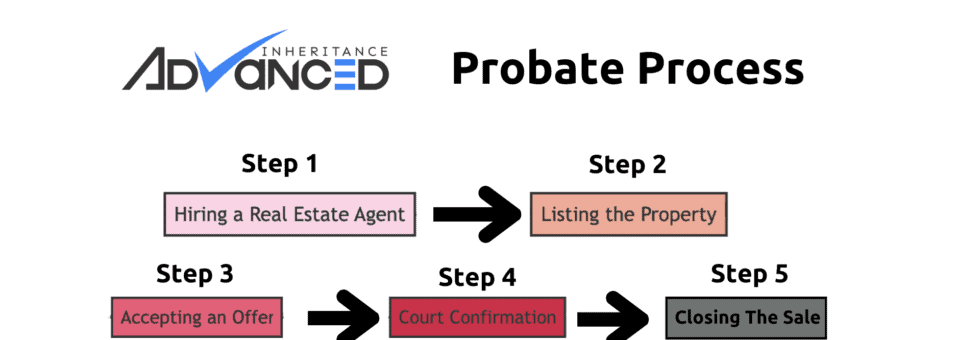

The Process of a Probate Sale

The process of a probate sale can be complex and time-consuming, as it involves several steps and requires court supervision. Here’s a general overview of how a probate sale works:

Hiring a Real Estate Agent: The first step in organizing a probate sale is to hire a real estate agent. It’s advisable to hire an agent with experience in probate sales, as they will be better prepared to navigate the unique aspects of this type of transaction. The agent will be responsible for listing the property, showing it to potential buyers, and managing the sale process.

Listing the Property: The property is then listed for sale, typically at a price that’s determined by an independent appraisal. The listing should clearly state that the property is being sold as part of a probate sale.

Accepting an Offer: Once a buyer makes an offer on the property, the estate’s representative must decide whether to accept it. It’s important to note that even if the representative accepts the offer, the sale isn’t final at this stage.

Court Confirmation: After an offer is accepted, a court hearing is scheduled to confirm the sale. This process can take 30 days or even longer. During the hearing, other potential buyers may also submit overbids in an attempt to purchase the property. If no overbids are made, or if the original buyer’s offer is the highest, the court will confirm the sale to that buyer.

Closing the Sale: Once the court confirms the sale, the closing process can begin. This involves finalizing the paperwork, transferring the title to the buyer, and distributing the proceeds of the sale. The proceeds are first used to pay off any debts, taxes, and expenses of the estate, with the remaining funds distributed to the heirs.

It’s important to note that the specifics of the probate sale process can vary depending on the laws of the state where the property is located. Therefore, it’s crucial to consult with a legal professional or a real estate agent experienced in probate sales to ensure that all legal requirements are met.

3. Pros and Cons of Buying a Probate Sale

Buying a property through a probate sale can be an attractive option for many buyers, but it’s important to understand both the potential benefits and drawbacks before proceeding. Here’s a look at some of the pros and cons of buying a probate sale:

Pros:

Potential for Lower Prices: One of the main advantages of buying a probate sale is the potential for lower prices. Because the goal of a probate sale is often to sell the property quickly and pay off the estate’s debts, the property may be listed at a price that’s below its market value. This can present a great opportunity for buyers looking for a deal.

Less Competition: Probate sales can be less competitive than traditional real estate sales. This is because they require a more complex and time-consuming process, which can deter some buyers. If you’re willing to navigate this process, you may find that there’s less competition for the property you’re interested in.

Cons:

As-Is Condition: Probate properties are typically sold in as-is condition. This means that the estate won’t make any repairs or improvements before the sale. While this can contribute to a lower price, it also means that the buyer may need to invest in repairs or renovations after the purchase.

Longer Process: The process of buying a probate sale can be longer than a traditional real estate transaction. This is because the sale needs to be approved by the court, which can take several weeks or even months. Buyers need to be prepared for this extended timeline.

Potential for Overbidding: During the court confirmation hearing, other buyers have the opportunity to overbid on the property. This can result in a bidding war, which may drive up the price of the property.

Uncertain Outcome: Even if your offer is accepted by the estate’s representative, the sale isn’t final until it’s confirmed by the court. This means there’s a level of uncertainty involved in the process, as the court could potentially reject the sale or accept a higher bid from another buyer.

While buying a probate sale can present some unique opportunities, it also comes with its own set of challenges. It’s important for buyers to fully understand the process and to seek legal advice before proceeding.

Why Homes are Sold Through Probate Court

Homes are sold through probate court for a variety of reasons, often related to the circumstances surrounding the deceased person’s estate. Here are some common reasons why a home might be sold through probate court:

Paying Off Debts: If the deceased person left behind significant debts, the estate may need to sell assets, including the home, to pay off these debts. The probate court oversees this process to ensure that all creditors are paid in a fair and orderly manner.

No Will or Trust: If the deceased person did not leave a will or establish a trust, the probate court will determine how the estate’s assets, including the home, are distributed. This often involves selling the home and dividing the proceeds among the heirs.

Disputes Among Heirs: If there are disputes among the heirs about what should be done with the home, the probate court may decide to sell the home and divide the proceeds among the heirs. This can help to avoid further conflict and ensure a fair distribution of the estate’s assets.

Need for Liquid Assets: Sometimes, the estate may need to convert the home into liquid assets to pay for expenses such as taxes, legal fees, or the cost of maintaining other assets. In these cases, selling the home through probate court can be a practical solution.

Lack of Interest from Heirs: In some cases, the heirs may not be interested in keeping the home. They may live out of state, already own a home, or simply not want the responsibility of owning and maintaining the property. In these cases, selling the home through probate court allows the heirs to receive their share of the estate in cash.

It’s important to note that selling a home through probate court can be a complex process, requiring the guidance of a probate attorney or a real estate agent experienced in probate sales. Always seek professional advice when dealing with probate matters.

5. Unique Features of a Probate Sale

Probate sales differ from traditional real estate transactions in several ways. Understanding these unique features can help both buyers and sellers navigate the process more effectively. Here are some of the unique aspects of a probate sale:

As-Is Condition: In a probate sale, the property is typically sold in its current, as-is condition. This means that the estate will not make any repairs or improvements before the sale. Buyers must be prepared to accept the property with all its existing issues and potential need for repairs or renovations.

Court Approval Required: Unlike a standard real estate transaction, a probate sale requires court approval. Even after the estate’s representative accepts an offer, the sale isn’t final until it’s confirmed by the court. This process can take several weeks or even months, which can significantly extend the timeline of the sale.

Deposit Requirement: Buyers in a probate sale are often required to provide a deposit of 10% of the purchase price at the time they make their offer. This deposit is typically non-refundable if the buyer fails to complete the purchase.

Overbidding Opportunities: During the court confirmation hearing, other buyers have the opportunity to overbid on the property. This can result in a bidding war, potentially driving up the final sale price.

No Contingencies: In a probate sale, there are typically no contingencies. This means that the buyer cannot back out of the sale due to issues discovered during an inspection or difficulties securing financing.

Navigating a probate sale can be complex due to these unique features. Whether you’re a buyer or a seller, it’s important to seek legal advice and work with a real estate agent experienced in probate sales to ensure a smooth process.

6. The Role of an Estate Attorney in a Probate Sale

The role of an estate attorney in a probate sale is crucial. They provide legal advice, guide the executor or administrator of the estate through the process, and help ensure that all legal requirements are met. Here’s a closer look at what an estate attorney does in a probate sale:

Providing Legal Advice: An estate attorney provides legal advice to the executor or administrator of the estate. They help them understand their responsibilities, the probate process, and the legal implications of their decisions.

Guiding the Process: The estate attorney guides the executor or administrator through the probate process. They help with tasks such as filing the necessary paperwork with the court, notifying creditors, and managing the estate’s assets.

Overseeing the Sale: The estate attorney oversees the sale of the property. They work with the real estate agent to list the property, accept offers, and complete the sale. They also ensure that the sale complies with all legal requirements and that the proceeds are distributed correctly.

Representing the Estate in Court: If necessary, the estate attorney represents the estate in court. They may need to defend the estate against claims from creditors or disputes among heirs. They also represent the estate during the court confirmation hearing for the sale.

Ensuring Legal Compliance: The estate attorney ensures that the executor or administrator complies with all legal requirements. This includes paying taxes, settling debts, and distributing the estate’s assets according to the will or state law.

In conclusion, an estate attorney plays a vital role in a probate sale. Their expertise and guidance can help ensure a smooth process and protect the interests of the estate and its heirs. Whether you’re an executor, an administrator, or a potential buyer in a probate sale, it’s always a good idea to seek legal advice.

7. Understanding the Legal Aspects of a Probate Sale

A probate sale involves several legal aspects that both sellers and buyers need to understand. The sale is overseen by the probate court, which ensures that the property is sold at a fair price and that the proceeds are used to settle the estate’s debts. The court also confirms the sale and can accept overbids from other potential buyers. Additionally, the property is typically sold in as-is condition, meaning the estate won’t make any repairs or improvements before the sale. Understanding these legal aspects can help you navigate a probate sale more effectively.

8. How to Prepare for a Probate Sale as a Buyer

As a buyer preparing for a probate sale, there are several steps you can take. First, do your research to understand the process and the unique aspects of a probate sale. Consider hiring a real estate agent with experience in probate sales to guide you through the process. Be prepared for the property to be sold in as-is condition and for the possibility of overbidding during the court confirmation hearing. Finally, be patient, as the probate sale process can take longer than a traditional real estate transaction.

9. How to Navigate a Probate Sale as an Heir or Personal Representative

If you’re an heir or personal representative navigating a probate sale, it’s important to seek legal advice. An estate attorney can guide you through the process and ensure you meet all legal requirements. You’ll also need to work with a real estate agent to list the property and manage the sale. Be prepared for the sale to take several weeks or even months, as it requires court approval. Also, be aware that the property will be sold in as-is condition and that other potential buyers can overbid during the court confirmation hearing.

10. Common Challenges in a Probate Sale and How to Overcome Them

Probate sales can present several challenges. These include the property being sold in as-is condition, the extended timeline due to the need for court approval, and the potential for overbidding. To overcome these challenges, it’s important to understand the process, be patient, and be prepared for potential issues. Hiring professionals, such as an estate attorney and a real estate agent, can also be extremely helpful in navigating these challenges.

Is a Probate Sale Right for You?

Probate sales can be complex, but with the right understanding and preparation, they can present unique opportunities for both buyers and sellers. Whether you’re an heir managing an estate, a personal representative overseeing a probate sale, or a potential buyer looking for a property, it’s crucial to understand the process, the legal aspects, and the potential challenges involved in a probate sale.

At Inheritance Advance, we’re here to help you navigate this process. We offer a range of services to assist with probate issues, and our team of experts is always ready to provide guidance and support. Whether you need help understanding the probate process, managing an estate, or securing an advance on your inheritance, we’re here to help.

Remember, every situation is unique, and what works best for one person may not work as well for another. Always seek professional advice when dealing with probate matters. Contact us today at Inheritance Advance to learn more about how we can assist you with your probate needs.