A testamentary trust is created by the provisions in a will and typically comes into existence after the writer of the will dies. A testamentary trust is a legal entity that starts upon someone’s death. The will names the trustee to manage assets for beneficiaries and it protects those same things from any risks or dangers they may face during life, such as fires in buildings where someone had businesses located on them; these can cause lots of trouble with lawsuits if not handled properly.

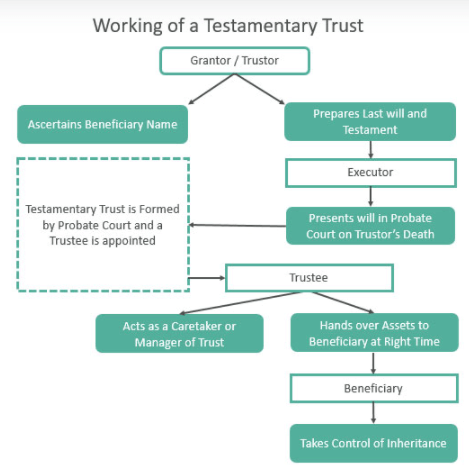

How Does a Testamentary Trust Work?

A testamentary trust is a trust that’s established in accordance with the instructions contained within your last will and testament. A fiduciary relationship allows for a trustee to manage assets on behalf of beneficiaries who are also known as successors-inheritors or legatees (depending upon how the trust is worded).