Housing prices have risen dramatically since the housing crash of 2008. This has created wealth amongst many Americans and that wealth is being passed down to the next generation. The average inheritance has only risen by around $15,000 in three decades, but they have more than doubled for some Americans.

In this article, we’ll go over inheritance and some of the statistical studies we referenced.

Average Inheritance Statistics In The United States

The Survey of Consumer Finances (SCF) provides valuable insights into inheritance statistics in the United States. Here are the key inheritance statistics:

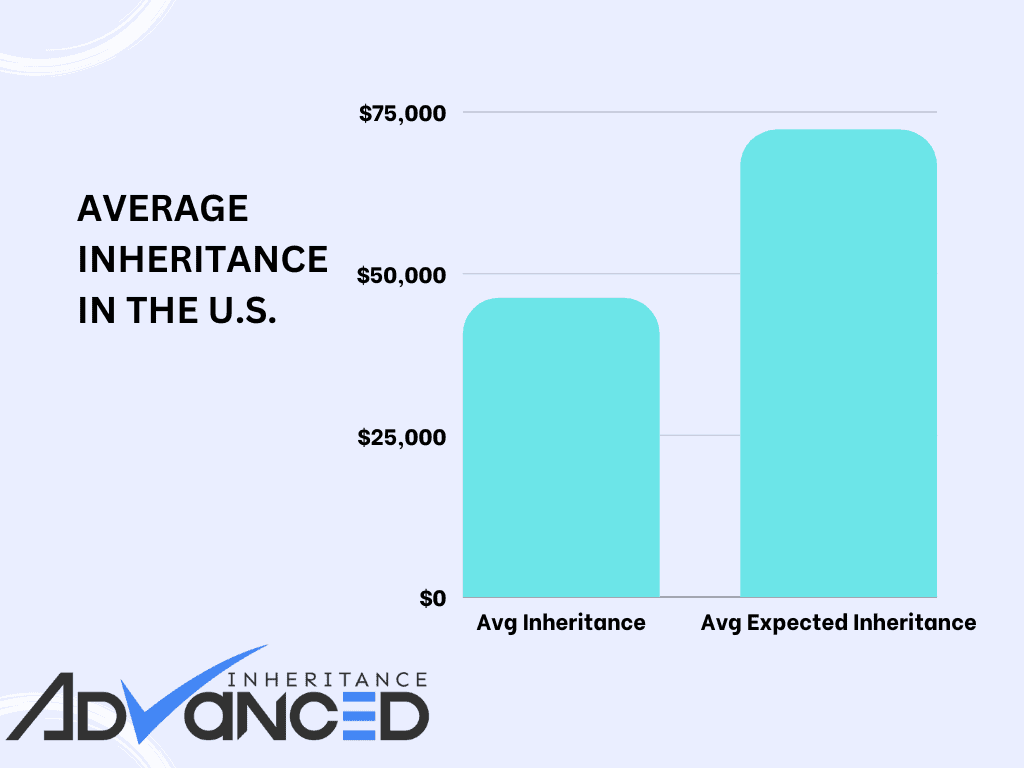

- The average inheritance received is $46,200

- The average expected inheritance is $72,200.

However, these figures can vary significantly across different demographic groups. For example:

- The wealthiest families expect to inherit significantly more than the average, with the top 1% expecting to inherit over 42 times more than the bottom 50%.

- The median inheritance for groups younger than 46 or older than 75 is consistently under $10,000.

Furthermore, racial disparities are evident, with White households inheriting over 5.3 times as much as Black households and 6.4 times as much as Hispanic households. These statistics highlight the complex dynamics of wealth transfer and inheritance in the United States.

7 Interesting Inheritance Statistics

It is difficult to provide general statistics on inheritance because it can vary greatly depending on a number of factors, including the size and nature of the estate, the state in which the deceased lived, and the laws governing inheritance in that state.

However, here are a few general statistics about inheritance that may be of interest:

-

According to a survey conducted by the National Association of Estate Planners & Councils, about 50% of American adults do not have a will.

-

In the United States, inheritance laws differ by state. Some states follow the principle of “intestacy,” which means that if a person dies without a will, their assets will be distributed according to state law. Other states follow the principle of “community property,” which means that assets acquired during the marriage are considered jointly owned and are divided equally upon the death of one spouse.

-

According to the U.S. Census Bureau, in 2017, the median value of estates was $69,000 for men and $41,000 for women.

-

A study conducted by the Urban Institute found that in 2013, the top 20% of households by wealth held 89% of all inherited wealth, while the bottom 80% of households held just 11% of inherited wealth.

-

According to a survey conducted by the Pew Research Center, about 60% of Americans believe that it is important to leave an inheritance to their children or other heirs, while 40% believe that it is not important.

-

For estates of $40,000 or less, the average attorney fee is $1,500. For estates between $40,000 and $70,000 the estate attorney fee raises to $2,250. For estates between $70,000 and $100,000: $3,000. For estates between $100,000 and $900,000: 3% of the estate’s value is an average amount of money for attorneys to charge. This ads up to hundreds of millions of dollars in probate fees per year that Americans end up paying.

-

According to the Los Angeles Times Americans inherited $427 billion in 2016, the most recent data available, up 119% from 1989 even after adjusting for inflation.

It is worth noting that these statistics are just a general overview, and the specifics of inheritance can vary significantly from one individual to another.

Search Trends For Estate Tax

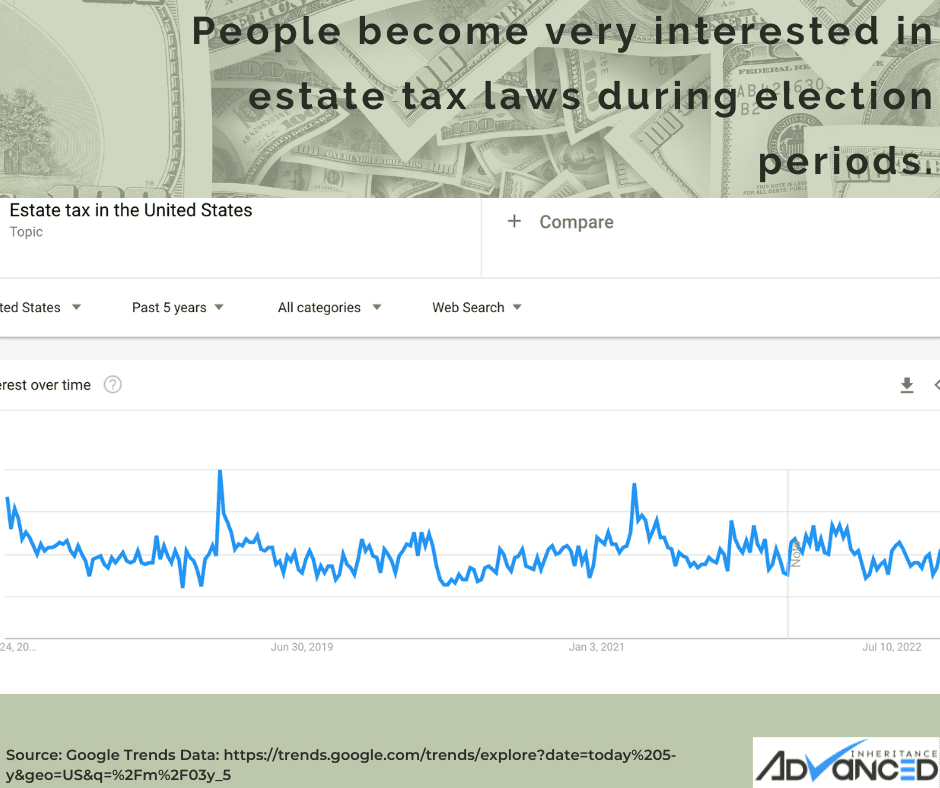

We conducted a statistical study based on google search trends data and found that inheritance and estate tax in the united states are breakout topics and recieve maximum interest during election times.

Estate And Inheritance Taxes By State

States with an estate tax:

- Connecticut

- Illinois

- Maine

- Massachusetts

- Minnesota

- New York

- Oregon

- Rhode Island

- Vermont

- Washington (state)

States with an inheritance tax:

Estate and Inheritance Tax

States like California have gotten rid of inheritance and estate tax and also tend to have larger inheritances because property values have increased so much over generations.

There are millions of dollars in unclaimed inheritance

There are millions of dollars in the united states that have been forgotten and are unclaimed, waiting for a home. of forgotten funds waiting to be claimed. More than 8% of American adults are millionaires. When they pass away the assets go to the designated beneficiary or they go through probate. Many times other heirs have passed away or they are not aware of the financial standing of the decedent and the funds end up forgotten. You can search for unclaimed inheritance assets at www.Unclaimed.org, the website of the National Association of Unclaimed Property Administrators (NAUPA).

The Biden Inheritance Tax Plan

Wealthy families could face combined tax rates of as much as 61% on inherited wealth under President Joe Biden’s tax plan, according to recent analysis and tax accountants.

Americans are becoming more concerned with inheritance tax laws

We conducted a search for inheritance-related queries using google search trends. We found that search volume for inheritance tax laws and probate related search terms has doubled in the past two years.

Final Thoughts On Inheritance Statistics

If you are concerned about passing your inheritance down to your heirs than an estate planning attorney can be a great asset. Protecting your assets so that they incur the smallest amount of attorney’s fees and taxes is a skill that estate planning attorneys have. If you find yourself already in probate, then you can learn more about the probate process in our articles or receive early inheritance funding.

- “Survey of Consumer Finances (SCF).” Federal Reserve Board, https://www.federalreserve.gov/econres/scfindex.htm. Accessed 22 June 2023.

- “Inheritances by Age and Income Group.” Penn Wharton Budget Model, 16 July 2021, https://budgetmodel.wharton.upenn.edu/issues/2021/7/16/inheritances-by-age-and-income-group. Accessed 22 June 2023.

- “Inheritances by Race.” Penn Wharton Budget Model, 17 Dec. 2021, https://budgetmodel.wharton.upenn.edu/issues/2021/12/17/inheritances-by-race. Accessed 22 June 2023.

- “Wealthiest Families Expect to Inherit Nearly $1.7M.” MagnifyMoney, https://www.magnifymoney.com/blog/news/inheritance-study/. Accessed 22 June 2023.

- “Anticipating an Inheritance? What to Really Expect.” MassMutual Blog, https://blog.massmutual.com/planning/why-you-should-not-expect-to-live-off-your-inheritance%E2%80%8B. Accessed 22 June 2023.

- “Average Inheritance: How Much Are Retirees Leaving to Heirs?” NewRetirement, https://www.newretirement.com/retirement/average-inheritance-how-much-are-retirees-leaving-to-heirs/. Accessed 22 June 2023.

- https://www.nolo.com/legal-encyclopedia/intestate-succession-state-laws.html)

- https://www.census.gov/content/dam/Census/library/publications/2019/demo/p60-266.pdf)

Share Our Blog With Someone It Might Help!