When people suffer the loss of a family member it leaves a void. Even though they are working through the grief, things can become much worse if the heir becomes the victim of inheritance scams. Scammers try new ways to scam people out of money all the time. They don’t take days off and they don’t care if you recently lost a family member. That’s when they like to strike the most; when you are dealing with grief and not thinking clearly.

Let’s set the record straight, chances are very good that you don’t have a distant relative with millions of dollars in cash owed to you if you aren’t already aware of it. Don’t ever pay money and provide bank account information if you don’t have a good handle on the situation.

If you are, in fact, in line for a large inheritance from a family member or friend, it’s important to know how to spot the signs of potential inheritance scams so you don’t lose your inheritance before you even take possession of it.

In this article, we’ll tell you about all the latest inheritance scams so you don’t end up parting with your money.

Jump To Section

What is an Inheritance Scam?

First and foremost, you should never share personal information with anyone you do not know or trust – whether you expecting an influx of money or not. Vulnerable information includes your bank account details, social security number, passwords to any of your accounts, or any identifying information specific to you. You should never share this information with anyone until you know for certain they are who they report to be. The legal and financial aspects of a scam involving your inheritance can lead you to pay money to someone you truly don’t know. Sadly, when an inheritance is being distributed it’s usually a stressful time and scammers try and take advantage of it.

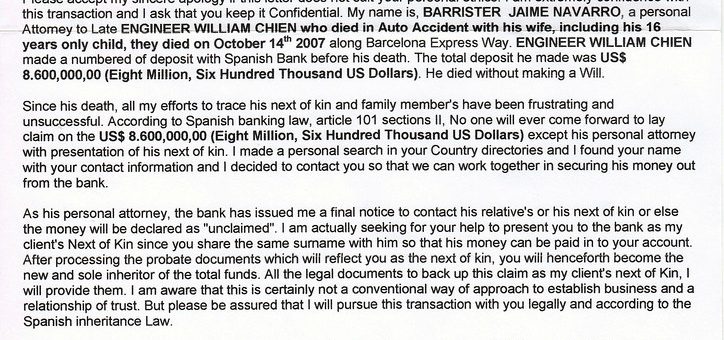

The majority of inheritance scams begin with an email message or a mailed letter explaining that you have a distant relative that recently passed and are in line for an inheritance- even though that person is a complete stranger to you. They may request for you to send money electronically for legal fees or to cover other expenses to get the money to you, or will request that you verify your identity by sharing some of your personal information, or maybe they have other stories to tell. What’s concerning is falling for this scam once could cause problems far reaching problems for you – t ey will try to get any info they can use to get access to your money.

There are many reasons why this type of communication may seem legit upon first glance:

- The correspondence sent by the scammer looks “real” and may show that it came from a law firm

- The letter may be printed on letterhead using the name of a legitimate law firm

- There are cases where probate attorneys search for family members of a deceased person and contact them.

Examples Of Inheritance Scams

It’s important to know what to look for to identify if correspondence received from total strangers is legitimate or not. Some scam attempts have obvious warning signs. In the example below, the “dear sir/madam” kind of gives it away. Look for misspelled words or blatant typos. You can search online for the person or the law firm in the signature line or even the relative they claim you have. Also, just trusting your instinct is usually the best weapon you have. Ask questions and ask for verification if you do decide to dig deeper when you get a letter like this. Luckily, you can just ignore a letter in your mail or block a sender in you get an email if you identify the warning signs from the start – and hopefully that will be the end of it. Unfortunately, there are other scams that are much more far reaching and treacherous. If a thief is more sophisticated they may be able to get access to your information as soon as you click in an email. Or they may get you to share identifying information even if you don’t realize it. Always be skeptical when dealing with someone you don’t know and can’t verify. If it sounds too good to be true, it probably is. If you have received correspondence like this in your email, block them from your email account and report it to the Federal Trade Commission or to the Internet Crime Complaint Center.

Some thieves may be lying in wait for their chance to strike instead of just contacting you out of the blue. They have been know to pose as family members or friends you are close to that may be in trouble. These scammers can find information of loves ones and set the name on their sender’s email address so it looks like it is coming from someone you actually know. If you actually click into the email or look closely at the identifying information, you will see that the email address might be off by one letter or number from the real person. They may even pose as your boss asking for help. There have been instances of accounting department representatives getting an email from the CEO saying that he has run into an emergency and can’t talk right now but needs you to wire a large amount of money immediately. You may get a call that your granddaughter is in legal trouble and needs you to send money to help resolve it. To ensure you don’t fall victim to these attempts learn to protect yourself and make sure you take precautions. For instance, if you ever do have to send money through a wire transfer, make sure that you double confirm the identity of the receiving party and talk to them personally. Don’t trust an email that can be faked – call the person on the phone and verify the situation. Whenever you are transferring money anywhere it pays to be extra prudent and confirm the sender.

Inheritance Scam Statistics

How the Scammers Make Their Money

In some of the scams we have described, the amount of money requested may seem minimal. he fee is typically described as an administrative fee to process the will and ultimately send the inheritance to the beneficiary that the deceased left behind. That fee often falls around the $20, $30, or $40 mark, making the victim comfortable enough to send the money because it is a small amount to lose.

The trick here is that they aren’t worried about the administrative fee. They want to build trust with you so they can gain access to your bank account information. The scammer will tell the victim that the inheritance will be wired to their account after the receipt of the administrative fee. That’s how they obtain the account information and wipe out all of your savings, use your credit cards, and steal your identity.

The scammers purchase lists that feature the contact information for thousands of names. They are then able to send not just emails, but also text messages, and letters to these people to make the correspondence seem legitimate. Even if just one person from the list falls for the scam, these people have already made the money back that they spent to purchase the list of information.

How To Protect Yourself From Inheritance Scams

Every communication sent will likely have a host of errors. These errors will include spelling mistakes and grammatical errors. Scammers do this on purpose in an effort to weed out the people who spot the errors, know it’s not legitimate, and won’t follow through on providing the bank account information. Any legitimate legal documents would never come from a law firm without previous conversation occurring, and/or security measures taken. If you are ever in unsure, always take more steps to verify the sender’s identity.

Look for these things to identify a possible scam attempt:

- Incorrect personal details – misspelled names, signatures that don’t match up with the name given, etc…

- Request for personal information or passwords. Financial institutions do not ask for credit card information (as a rule your account details should never be shared)

- A company sending correspondence from a public domain name like Gmail or Yahoo

- The size of the supposed inheritance (if it seems too good to be true, it likely is)

- A fake address for the bank where the inheritance is being held, or a fake bank altogether

- An request to share your bank documents

- Asking you to transfer small amounts of money in order to receive a larger amount

- Requesting that you provide additional personal details

- A letter that says that you have an unclaimed inheritance from an unrelated wealthy person

- Correspondence that looks like it has been translated into your native language

Take Precautions:

- Protect your mobile phone by setting software to update automatically. These updates could give you critical protection against security threats.

- Protect your computer by using security software. Set the software to update automatically so it can deal with any new security threats.

- Protect your credit card accounts by using multi-factor authentication. Some accounts offer extra security by requiring two or more credentials to log in to your account. This is called multi-factor authentication. The additional credentials you need to log in to your account fall into two categories: 1. Something you have — like a passcode sent via text message or an authentication app. 2. Your Biometrics — like a scan of your fingerprint, your retina, or your face.

- Protect your data by backing it up. Back up your data and make sure those backups aren’t connected to your home network. You can copy your computer files to an external hard drive or cloud storage if desired. Back up the data on your phone, too.

Did You Receive a Scam Letter or Text Message?

If you have received a letter asking you to pay money to obtain an inheritance from a financial institution, you should not respond. Even if they have some of your personal information, that doesn’t mean it’s real.

Be sure not to click on any attached document or link in the body of an email from a stranger. Doing so could install malware on your computer that provides these people access to your accounts. Report the occurrence to the legal firm the scammer pretended to represent so they know that their name, logo, and other information was used as part of a probate scam .

Word To the Wise: Never pay money and provide personal information to anyone you don’t know or trust or risk parting with your money. Seek advice from an independent professional such as a lawyer, accountant or financial planner if in doubt. Always confirm wire transfers over the phone and not only in email. If you’ve received a suspicious letter in the mail or by email claiming there’s an inheritance waiting for you or feel you’ve been a victim of a fake estate locator scheme, report it to the local U.S. Postmaster, U.S. Postal Inspection Service office, your state’s Attorney General’s Office or the Better Business Bureau or FBI.

We are not a security firm and have no incentive to help the public regarding inheritance scams other than our own moral responsibility to fight scammers trying to trick you into parting with your money. Since we deal with many beneficiaries that are in the probate and inheritance process, we have seen a lot of deceitful acts. Below we have included more frequently asked questions that might help you avoid being the victim of a scam.

Don't Wait For Probate

Frequently Asked Questions Related to Legal and Financial Aspects of Inheritance Money Latest Scams

What is an inheritance scam?

An inheritance scam is a type of fraud in which a scammer will contact a victim and claim that they are entitled to an inheritance, but that they need to pay a fee or provide personal information in order to receive it. In reality, there is no inheritance, and the scammer is simply trying to steal money or personal information from the victim.

How do I know if I am being targeted by an inheritance scam?

There are several red flags that may indicate that you are being targeted by an inheritance scam. These include unsolicited phone calls or emails, requests for personal information or payment of fees upfront, and promises of large inheritances from distant relatives or unknown benefactors. If you are unsure whether a request is legitimate, it is always best to do your research and seek advice from trusted sources.

What should I do if I suspect that I have been targeted by an inheritance scam?

If you suspect that you have been targeted by an inheritance scam, the first thing you should do is stop communicating with the scammer. Do not provide any personal information or payment, and do not engage in further conversation. You should also report the scam to the authorities, such as the Federal Trade Commission (FTC), so that they can investigate and potentially shut down the operation.

How can I protect myself from inheritance scams?

To protect yourself from inheritance scams, it is important to be cautious when receiving unsolicited phone calls or emails. Do not provide personal information or payment without verifying the legitimacy of the request. You can also research the company or individual making the request, and seek advice from trusted sources such as attorneys or financial advisors.

What should I do if I am actually entitled to an inheritance?

If you are actually entitled to an inheritance, it is important to do your due diligence and verify the legitimacy of the claim. You can consult with an attorney or financial advisor to ensure that the inheritance is legitimate and that you are taking the necessary steps to claim it. You can also consider options such as inheritance advances, which provide you with a portion of your inheritance upfront in exchange for a fee. However, it is important to carefully research any company offering inheritance advances to ensure that they are legitimate and reputable.

The advisors at Inheritance Advanced understand that your hard-earned money is precious. Take a look at some of our frequently asked questions on this issue below.

How do I really know if there is a wealthy benefactor in my life?

The best way to find out this information is to contact a legal firm near you or near where the family member lived. Avoid providing any information to scams so you do not lose your life savings.

What are the telltale signs of inheritance scams?

The correspondence will request that you need to pay someone via a wire transfer that invited overseas banks into the mix. Any request to send money overseas should immediately be flagged as a scam, even if the person named in the correspondence has the same last name as you.

Inheritance Advanced Can Help You With a Probate Advance

Legal trickery is all too common these days, especially with social networking message apps and finely crafted text messages with the goal to trick you into parting with your money. Do not fall for the claims that fortune awaits you from a scam offer. We encourage you to contact a law firm or the police if you believe you have become a victim to a scammer posing as a relative that has partaken in wire fraud and accessed your bank account.

We have more than 1,560 happy clients across the country. If you or a loved one are in probate and don’t have time to wait to receive your inheritance, we are able to help by providing an advance on those funds. Unlike the scammers, we have an A+ rating with the BBB and take great pride in helping our clients receive cash today.

Resources:

https://www.uspis.gov/news/scam-article/inheritance-scams

https://www.aspirefcu.org/blog/security/inheritance-scams-are-evolving-know-what-to-look-for/

https://www.forbes.com/sites/johnwasik/2017/02/19/scam-alert-anatomy-of-an-inheritance-fraud-letter/?sh=6e3cba083ecb

https://www.verizon.com/business/en-gb/resources/reports/dbir/